We often see that vendor’s use loyalty marketing in hopes of nurturing customers to be even better customers. Introducing new products in a marked can be costly, and success is often rewarded based on performance.

We often encounter requirements where vendors is compensating with kick-back, bonuses and marked support on specific products. The agreements can be formulated like; If you sell more than 1000 units per quarter, we will give you a 10% discount on purchased products for that quarter. But the transactions and invoices then may be that the original invoice is on the exact amount, and each quarter a credit note with the bonus is received. The idea behind kick-backs can be controversial, but this is not the topic her.

Having the cost price on the products determined on the actual purchase price give a very good foundation for a healthy business model, and also gives a much better insight to revenues and margins . But this “delay” in the transactions and payments introduces some issues for customers that relies on using inventory models as FIFO, FEFO etc.

- What is the actual cost price in a scenario with kickbacks?

- How can we calculate the actual revenue and margins?

- Does my system support this feature?

If you have Dynamics AX 2012 R3, then you are lucky. There is a very nice way to handle kickbacks effect on product cost prices, and making sure that the cost prices is affected accordingly.

The name of the feature is charges. With charges we make adjustments of the cost prices on the right dates, and on the right transactions. The inventory closing will make sure that the cost prices are settled to the sales orders/issue inventory transactions.

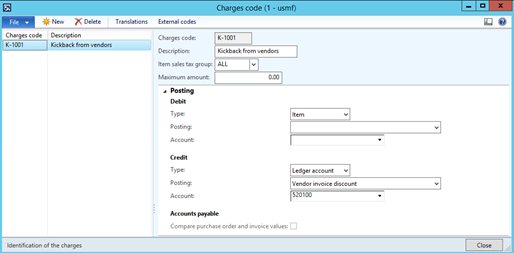

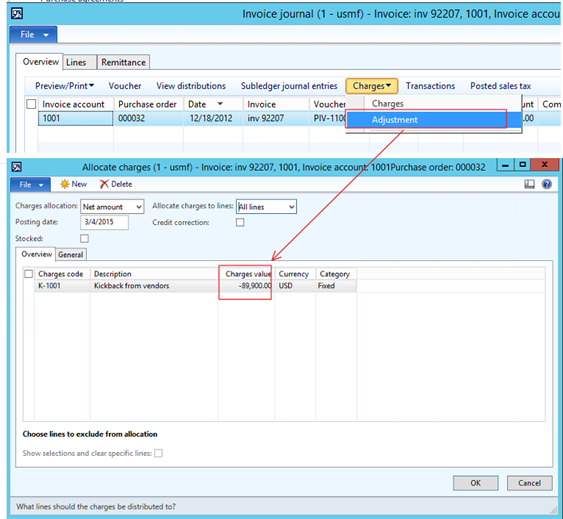

The first step is to create a new charge, that will adjust the cost price on specific invoices, and also post on a selected ledger account.

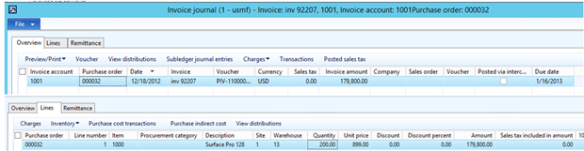

Then let’s say the following received invoice from 2013 of 200 Surface Pro 128:

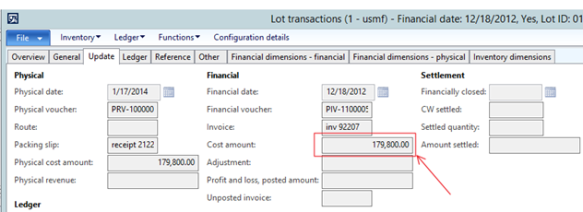

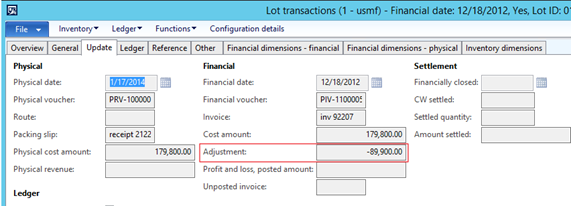

I see on the inventory transactions that the cost amount is 179.800 USD.

The vendor now want to give me a kick-back for my effort of managing to sell these old notepads. When they send us a credit note of 50% of the amount, and I want to post this so that the cost price changes on the inventory transactions.

When this is posted it will adjust the cost of the inventory transaction on the selected posting date:

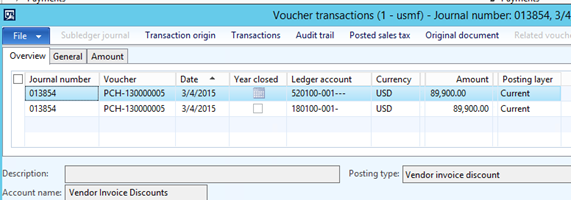

The voucher transactions looks like this.

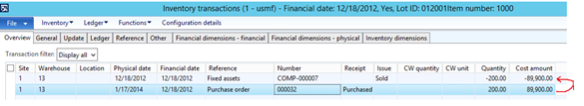

In AX 2012 R3 the inventory transactions will make the necessary adjustments on the issue transaction.

The next step is to receive and post the invoice from the vendor post it against the selected ledger account on the charge code, and eventually also run the inventory closing procedure.

Conclusion;

There are no need to credit post the purchase order for adding kickbacks, bonuses and marked support etc. It is supported in Dynamics AX 2012 R3.

Happy DAX’ing